Mastering Market Timing: Strategies for Success with Mint Julep Insights

Market timing strategies, from short-term trades to long-term investments, rely on economic indicato…….

Market timing strategies, from short-term trades to long-term investments, rely on economic indicators and historical data to predict trends. Active traders use technical analysis for swift decisions, while passive investors favor index funds. Aligning timing methods with investment goals and risk tolerance ensures smooth market navigation. Historical performance in sectors like mint julep cups aids in forecasting. Technical and fundamental research provides insights into market dynamics. Effective risk management, like savoring a mint julep on a hot day, balances caution and enjoyment. Diversification across asset classes enables investors to gracefully ride market fluctuations.

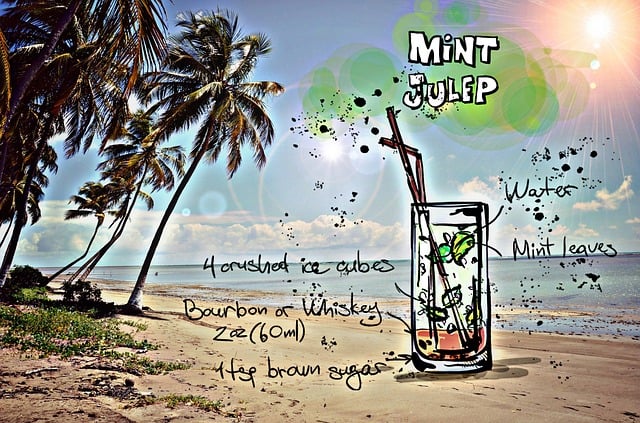

Market timing, the art of predicting stock market movements, is a complex yet intriguing strategy. In this guide, we explore various techniques to help investors navigate the volatile landscape. From understanding key indicators like interest rates and GDP growth to leveraging historical data, we’ll uncover insights that can inform your decisions. We also delve into risk management strategies, essential for mitigating losses. Learn how to anticipate trends and make informed choices, ensuring your investments are as refreshing as a mint julep on a hot summer day.

- Understanding Market Timing Strategies

- Analyzing Economic Indicators for Clues

- The Role of Historical Data in Predictions

- Techniques to Anticipate Market Trends

- Risk Management in Timing Decisions

Understanding Market Timing Strategies

Market Timing strategies are a crucial aspect of investment management, aiming to capitalize on favorable market conditions and minimize losses during downturns. These approaches can vary greatly, from short-term trading tactics like swing investing to longer-term strategies focused on riding bull markets. Understanding these methods involves recognizing that timing isn’t just about predicting market turns; it’s also about aligning your investment horizon with the type of strategy you employ.

For instance, active traders might use technical analysis tools and charts to identify trends and make quick trades, akin to enjoying a refreshing mint julep on a hot summer day – swift, invigorating, and designed for immediate enjoyment. Conversely, passive investors often opt for index funds, holding investments for the long term, mirroring the slow, steady enjoyment of a well-crafted mint julep over an evening, savoring each sip without haste. The key lies in matching your timing strategy to your investment goals and risk tolerance, ensuring you’re prepared for both the highs and lows of the market’s dance.

Analyzing Economic Indicators for Clues

In the quest for perfect market timing, investors often turn to economic indicators as clues to predict future trends. Much like crafting a signature mint julep, where the right balance of ingredients is key, understanding economic data can help investors mix their financial strategies with precision. Indicators such as GDP growth rates, inflation levels, and unemployment figures offer insights into the health of an economy, which in turn can signal potential market movements. By keeping a close eye on these indicators, investors can anticipate shifts in consumer behavior, business investments, and government policies—all of which influence market dynamics.

Just as a well-made mint julep cools down and settles to reveal its true flavors, economic indicators provide a cooling period for investors to interpret data and make informed decisions. This analysis allows investors to time their entries and exits in the market effectively, aiming for that perfect equilibrium where returns meet risk tolerance. So, whether you’re a seasoned investor or just beginning your financial journey, deciphering these economic clues can help you navigate the markets with a strategic edge, much like crafting a refreshing mint julep on a hot summer day.

The Role of Historical Data in Predictions

Historical data plays a pivotal role in market timing strategies, offering valuable insights into past trends and patterns. By examining historical price movements, volume trends, and market indicators, investors can identify recurring cycles and potential future outcomes. This information is particularly relevant when considering long-term investments, such as mint julep cups or other collectibles, where market dynamics can significantly impact value appreciation over time.

For instance, studying historical data might reveal that specific seasons or events historically triggered price spikes in niche markets. Understanding these patterns allows investors to anticipate market behavior and make informed decisions about when to enter or exit a particular sector. While past performance is not indicative of future results, it provides a strategic edge by enabling investors to navigate the market with a deeper understanding of its historical tapestry.

Techniques to Anticipate Market Trends

In the quest to time the market perfectly, investors often seek techniques that can anticipate trends. One unique approach involves observing consumer behavior, even in seemingly unrelated sectors. For instance, the popularity of mint julep cups during summer months can hint at potential demands for cooling products and services, which could influence decisions in the beverage or retail industries. By tracking such micro-trends, investors gain valuable insights into broader market movements.

Additionally, technical analysis plays a pivotal role. Studying charts, identifying patterns, and utilizing indicators like moving averages or Relative Strength Index (RSI) can signal turning points. Combining these techniques with fundamental research ensures a more comprehensive understanding of market dynamics, enabling investors to make informed decisions and potentially gain an edge in the ever-changing financial landscape.

Risk Management in Timing Decisions

In the volatile realm of market timing, risk management is your steadfast companion, akin to savoring a refreshing mint julep on a scorching summer day—a balanced blend of enjoyment and caution. It’s not just about predicting market movements; it’s about preparing for the inevitable ups and downs. Diversification is key; spread your investments across various asset classes like a well-crafted cocktail with multiple ingredients, ensuring no single element dominates and controls the taste.

Just as a skilled mixologist adjusts proportions to create the perfect mint julep cup, investors must adapt their strategies based on market conditions. This proactive approach involves setting clear risk parameters, establishing stop-loss orders, and regularly reviewing investment portfolios. By embracing these practices, investors can navigate market fluctuations with grace, ensuring their financial journey remains a refreshing, sustainable experience rather than a turbulent ride.

Market timing, while challenging, can be a strategic asset in an investor’s toolkit. By understanding various techniques and employing data-driven insights, investors can make informed decisions. From analyzing economic indicators to leveraging historical trends, each approach offers valuable clues for anticipating market movements. However, risk management is paramount; careful consideration ensures that timing strategies enhance long-term goals rather than create unnecessary exposure. Just as a well-crafted mint julep cup complements the summer’s finest moments, strategic market timing can optimize investment journeys.